What is ideal customer profile? A Practical Guide to B2B Success

January 13, 2026

Let's get straight to it: your Ideal Customer Profile (ICP) is a crystal-clear, data-driven description of the perfect company to sell your product or service to.

Think of it as a sniper scope for your sales team. Instead of firing wildly into the market and hoping for a hit, an ICP lets you zero in on the exact accounts that are most likely to buy, thrive with your solution, and become your biggest fans. It’s about ditching the guesswork and using real data to find your bullseye.

Why This Isn’t Just Wishful Thinking

Your ICP isn't a fantasy list of dream clients. It's a pragmatic profile built by analyzing your best existing customers. Who are they? They're the ones who renew without a fuss, have the highest customer lifetime value (LTV), and shout your praises from the rooftops.

By reverse-engineering what makes these accounts so successful, you create a repeatable model for finding more just like them.

An Ideal Customer Profile tells you precisely which companies to target and why. It uncovers the shared characteristics of your most profitable customers, turning your outbound strategy from a game of chance into a predictable revenue machine.

The Anatomy of a Powerful B2B ICP

At its heart, an ICP is all about firmographics—the characteristics of a company, just like demographics describe a person. This focus on the company is what makes an ICP the cornerstone of any serious B2B go-to-market strategy.

The table below breaks down the essential components that make up a strong ICP. Think of these as the coordinates for your sales and marketing efforts.

Ideal Customer Profile Key Components at a Glance

| Component Type | Data Points | Why It Matters |

|---|---|---|

| Firmographics | Industry/Vertical (e.g., FinTech), Company Size (e.g., 50-200 employees), Annual Revenue (e.g., $10M-$50M ARR) | Narrows the field to companies with the right scale, budget, and industry-specific pain points. |

| Geographics | Country, Region, City (e.g., North America, EMEA) | Focuses your efforts on territories you can effectively serve and where you have market traction. |

| Technographics | Existing Tech Stack (e.g., uses Salesforce, HubSpot), Software Infrastructure | Identifies companies with complementary or legacy systems that make your solution a natural fit. |

| Behavioral Signals | Recent Funding Rounds, Hiring Trends (e.g., hiring SDRs), Company Growth Trajectory | Pinpoints companies at a specific growth stage or with buying intent, signaling they are ready to invest. |

Having a clear picture of these elements helps every team, from marketing to sales to product, aim at the same target.

The Real-World Impact of a Sharpened ICP

Getting your ICP right isn't just an academic exercise; it has a massive impact on your bottom line. In the cutthroat B2B SaaS world, a well-defined ICP can be the difference between stagnation and explosive growth.

For example, one B2B tech company that took the time to refine its ICP saw a massive 25% jump in revenue while also improving customer retention. This happens because a sharp focus directs all your energy toward the companies that will bring in the most money and be the most successful long-term partners. For a deeper dive, you can find more insights on how a SaaS ICP fuels growth.

So, what is an ideal customer profile? It’s your strategic compass. It ensures your marketing campaigns, sales outreach, and even your product roadmap are all perfectly aligned to attract and win the customers that matter most. This alignment stops you from wasting time and money and makes your revenue growth far more predictable.

ICP vs Buyer Persona: Unpacking the Difference

It’s a common mistake, but one that can really trip up a sales team: using "Ideal Customer Profile" and "Buyer Persona" as if they mean the same thing. They don't. Getting this wrong is like mixing up the address of an office building with the name of the person you’re meeting inside. Both are crucial for finding your way, but they serve completely different purposes.

Your Ideal Customer Profile (ICP) is all about the company. Think of it as a blueprint for the perfect account. It's built on hard data—firmographics like industry, company size, annual revenue, and maybe even the specific tech they use. The ICP answers one big question: "Which companies are a perfect match for our product and will get the most value from it?"

A Buyer Persona, on the other hand, zooms in on the people who work at those ideal companies. This is where you get into the human element. Personas are semi-fictional characters based on real data, detailing things like job titles, daily frustrations, career goals, and what keeps them up at night. The persona answers: "Who do I actually need to talk to, and what do they care about?"

Focusing on the Right Level

Getting this distinction right is everything in B2B outbound. The ICP is your first, most important filter. It stops your team from wasting cycles chasing accounts that can’t afford you, don't need you, or are just a fundamentally bad fit.

Once your ICP helps you identify a great-fit company, that's when you pull out your buyer personas. After all, you don't sell to a building; you sell to the people inside it. Your approach to a Head of Engineering will be wildly different from your pitch to a CFO, even if they work down the hall from each other.

Your ICP tells you which buildings to enter. Your Buyer Personas tell you whose doors to knock on and what to say when they answer. You absolutely need both to navigate the B2B sales landscape successfully.

ICP vs Buyer Persona: A Direct Comparison

To really hammer this home, let’s put them side-by-side. This table breaks down the core differences, showing how each framework guides a different part of your GTM strategy, from high-level targeting all the way down to the words you use in an email.

| Attribute | Ideal Customer Profile (ICP) | Buyer Persona |

|---|---|---|

| Focus | The Company/Account | The Individual/Person |

| Data Type | Firmographics (e.g., revenue, industry, tech stack) | Psychographics (e.g., goals, challenges, motivations) |

| Purpose | To identify the best-fit accounts to target. | To understand the decision-makers within those accounts. |

| Answers | "Which companies should we sell to?" | "Who do we need to convince, and how?" |

At the end of the day, your ICP defines the strategic "where," while your buyer personas inform the tactical "who" and "how." When used together, they create a powerful one-two punch for your outreach. First, you find the right ponds to fish in (the ICP), and then you use the right bait to catch the right fish (the Persona). This approach makes sure your outbound efforts are not just efficient, but also genuinely resonant.

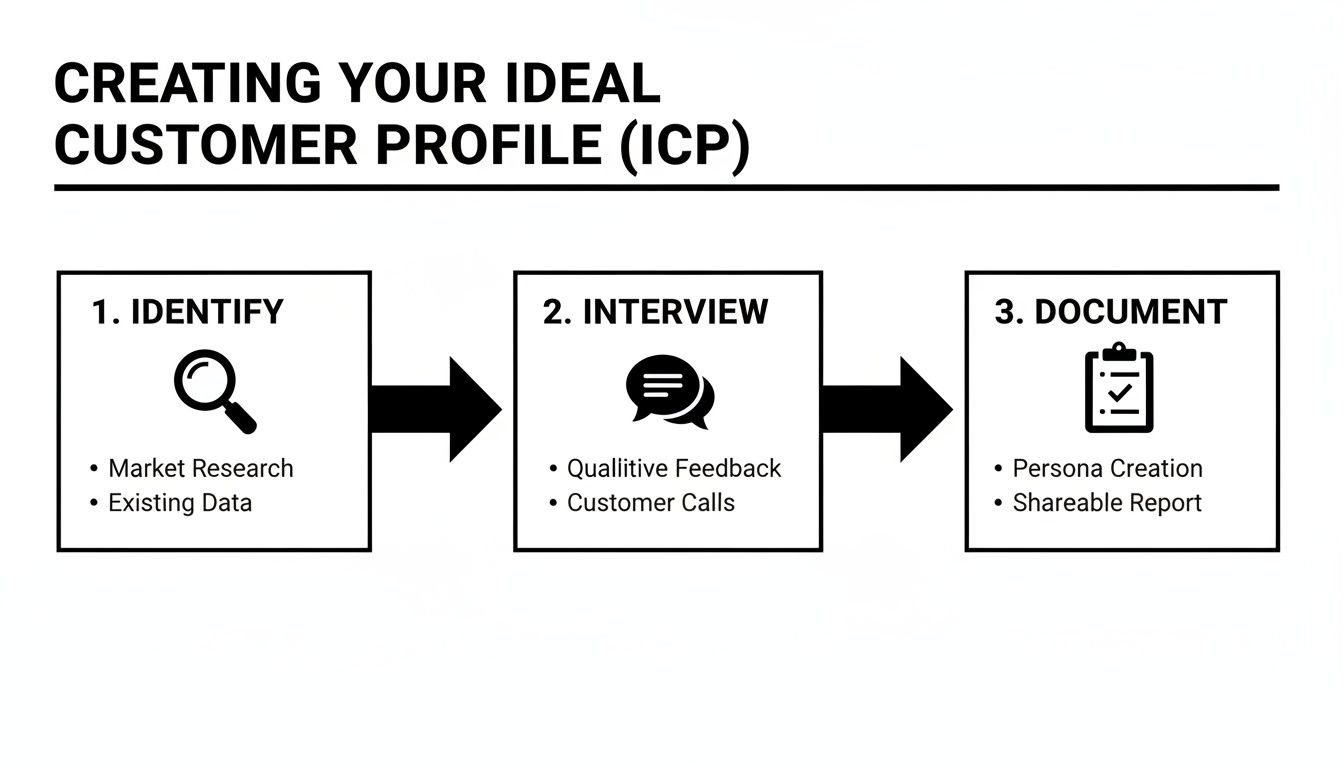

How to Create Your Ideal Customer Profile

Building your Ideal Customer Profile isn’t about throwing darts at a wall and hoping something sticks. It's a structured process that blends hard data with real human insight. Think of it as moving from a vague idea of who you think you should sell to, into a practical, actionable blueprint that gets your entire revenue team on the same page.

This approach ensures your final ICP is a true reflection of the market segment where you can consistently win, not just a wish list. Let’s walk through the steps to build this powerful strategic asset from the ground up.

Start with Your Best Customers

The quickest way to figure out who you should be targeting tomorrow is by looking at who’s already winning with you today. Your best customers are the ones who get the most value from your product, stick around the longest, and don’t drain your support team. They're your blueprint for success.

Start by making a list of your top 10-20 customers. "Best" isn't just about revenue. Look for a mix of qualities:

- Highest Revenue: Who brings in the most cash?

- Highest Product Adoption: Who’s really using your solution to its fullest potential?

- Fastest Sales Cycle: Which deals closed smoothly and without a ton of friction?

- Strongest Advocates: Who’s out there giving you testimonials, referrals, and glowing case studies?

Once you have this list, you've got the raw material for your analysis. These companies hold all the clues you need to build a repeatable sales engine.

Uncover Commonalities with Data

Okay, you have your list of top customers. Now it's time to put on your detective hat. The goal here is to find the common threads—the firmographic and technographic details—that tie these great accounts together. You're looking for the patterns that scream "good fit."

Modern ICPs go way beyond basic demographics. Today, B2B teams pull in richer data sets, including firmographics (company stats), technographics (their tech stack), and even behavioral signals. Targeting companies by specific attributes like size (100-500 employees), industry (SaaS or fintech), and revenue ($10-$100M) can lead to prospects that are 2-3 times more likely to convert than those found through spray-and-pray outreach.

As you dig into the data, ask yourself:

- Industry: Are most of your best clients in a specific vertical, like eCommerce or Healthcare?

- Company Size: Is there a sweet spot for employee count (e.g., 50-250 employees) or annual revenue?

- Geography: Are they clustered in a particular region or country?

- Technology Stack: Do they all use a specific CRM like Salesforce or a particular marketing automation platform?

Get all of this down in a spreadsheet. This quantitative data creates the skeleton of your ICP, giving your team objective criteria to use for prospecting and qualification.

Add Qualitative Insights Through Interviews

Data tells you what your best customers look like, but interviews tell you why they bought from you in the first place. This is where you add the color and context that bring your ICP to life. You need to get inside their heads to understand the motivations, challenges, and goals that sparked a purchasing decision.

Schedule a few quick chats with people from two key groups: your best customers and your own sales team.

For Customers: "What was going on in your business that sent you looking for a solution like ours? What specific headache does our product make go away?"

For Sales Reps: "What are the common pain points you hear from prospects who are a great fit? And what are the deal-killer objections you hear from accounts that aren't a good fit?"

These conversations will uncover the triggers, pain points, and desired outcomes that your data can't show you. You’ll hear—in your customers' own words—about the business challenges that led them to you and the value you deliver.

Synthesize and Document Your ICP

The final step is to pull all of your research together into a single, clear document. This profile needs to be so straightforward that anyone in your company, from a brand-new sales rep to a product manager, can pick it up and immediately understand who you're targeting.

A solid ICP document usually includes:

- A Summary Statement: A single sentence that describes your ideal customer. For instance, "Series B SaaS companies in North America with 50-200 employees using HubSpot."

- Firmographic Criteria: A bulleted list of your data-backed attributes (industry, company size, revenue, location).

- Technographic Criteria: The key technologies they use that signal they’re a good fit (e.g., Salesforce, Marketo, AWS).

- Key Pain Points: The top 3-5 business challenges your product is built to solve for them.

- Buying Triggers: The common events that signal an urgent need for your solution (e.g., a recent funding round, hiring a new VP of Sales).

- Red Flags: The characteristics of companies that are a bad fit (e.g., too small, no technical resources, operate in a non-compliant industry).

When building your ICP, it all starts with learning how to identify your target customers who are actually ready to buy. This document becomes your team's North Star, making sure everyone is aligned on who you're going after and why.

Real-World ICP Examples for B2B Companies

Theory is great, but let's be honest—it doesn't really click until you see it in action. An ICP can feel like a bunch of abstract data points until you watch it come to life as a clear, actionable guide for your sales and marketing teams.

To make this crystal clear, we'll walk through three completely different ICP examples. Think of these less as templates and more as strategic blueprints, each built to solve a specific business problem, whether that's scaling outbound or just making sales more efficient.

Example 1: The Growth-Stage SaaS Startup

Picture a SaaS company fresh off its Series A funding round. The goal is simple: aggressive growth. They need to scale their outbound sales, and fast. Their perfect customer is a company that's also growing, is comfortable with new tech, and wants a solution that gives them a competitive edge.

They can't afford to target just anyone. They need to find companies primed to buy.

- Firmographics: B2B SaaS companies in North America, sitting between 50-200 employees with $5M-$20M in annual recurring revenue.

- Technographics: They’re already using a modern CRM like HubSpot or Salesforce and a marketing automation platform like Marketo.

- Behavioral Signals: A big one is a recent Series A or B funding announcement within the last 6 months. They're also actively hiring for sales roles (SDRs, AEs), which is a dead giveaway that they're trying to build out their revenue engine.

- Pain Points: Their biggest headache is building a predictable sales pipeline. They don't have the internal team to run a sophisticated outbound program and are getting beat by bigger, more established competitors.

Example 2: The Mid-Market Tech Company

Now, let's shift gears to an established tech company selling a complex, high-ticket software solution. Their problem isn't a lack of leads; it's a long, complicated sales cycle that drains resources. They need to improve their sales team's efficiency by targeting mature, stable companies with defined budgets and clear procurement processes.

Here, the ICP is all about finding companies with the organizational and financial maturity to handle a major investment.

- Firmographics: Companies in Financial Services or Healthcare with 500-2,000 employees and pulling in over $100M in annual revenue.

- Technographics: They're likely stuck on legacy on-premise software (think older enterprise tools like SAP or Oracle) and are showing signs of starting a digital transformation initiative.

- Behavioral Signals: They've recently hired a new CTO or CIO. You might also see them publishing case studies or white papers about improving operational efficiency.

- Pain Points: Outdated technology is holding them back with clunky, inefficient workflows. Their data is trapped in silos across different departments, which leads to poor decision-making and puts them at risk for compliance issues.

Putting together a profile like this means digging into your best existing customers, actually talking to them, and finding the common threads that tie them all together.

This process shows that a truly powerful ICP isn't just about the numbers; it's a blend of hard data and real human insight.

Example 3: The Lead Generation Agency

For our final example, consider a lead gen agency. They need clients who understand the value of a full pipeline but would rather outsource the heavy lifting. Their ideal customer is often another agency or a consultancy that needs to deliver high-quality leads for their clients without building out a whole outbound department from scratch.

This ICP hones in on businesses that get the "why" of sales pipeline but want to buy the "how."

An Ideal Customer Profile isn't a wish list of dream clients. It should be a direct reflection of the companies that already use and love your products, providing a data-backed model for finding more of them.

- Firmographics: Marketing or sales consulting agencies with 10-50 employees that serve a B2B client base.

- Technographics: They live in project management tools like Asana or Monday.com and use dashboard software like Databox to show clients their results.

- Behavioral Signals: You'll see them posting all over LinkedIn about lead generation strategies and client wins. The agency's founder or partners are probably frequent speakers at industry events.

- Pain Points: Their clients are demanding a steady stream of qualified meetings. The agency is struggling with the cost and headache of hiring, training, and managing an in-house SDR team for every single client campaign.

As you can see, each of these examples gives a team the focus it needs to aim their resources where they'll make the biggest splash.

How to Validate and Refine Your ICP

Building your Ideal Customer Profile is the starting line, not the finish. Think of that first draft as a solid hypothesis—an educated guess based on the best data you have right now. The real work begins when you put that hypothesis to the test in the wild.

An ICP gathering digital dust in a forgotten folder isn't just useless; it's a missed opportunity. The sharpest B2B companies treat their ICP as a living, breathing asset. They build a tight feedback loop to constantly validate and sharpen their aim, ensuring their outbound efforts stay effective as markets shift and their product evolves.

Track Performance with the Right KPIs

So, how do you know if your ICP is actually ideal? The numbers don't lie. If your profile is truly pointing you toward your best customers, it should show up in your sales and customer success metrics. The first step is to track the performance of accounts that fit your ICP against those that don't.

These key performance indicators (KPIs) will tell you if your assumptions are hitting the mark:

- Conversion Rates: Are leads matching your ICP converting at a higher clip through every stage of your funnel, from the first touchpoint to a closed deal?

- Sales Cycle Length: Do deals with ICP-aligned accounts close faster? A shorter sales cycle often means less friction and a more natural fit.

- Customer Lifetime Value (CLV): This is a huge one. Are these customers spending more over time through renewals, upsells, and expansions? A much higher CLV is a powerful signal you've found the right fit.

- Churn Rate: Do your ICP customers stick around longer? Lower churn is a clear indicator of higher satisfaction and better product-market fit.

If you see a clear, positive gap in these metrics for your ICP accounts, you’re on the right track. If the numbers are murky or a total wash, it’s a sign that some of your ICP criteria need a second look.

Create a Continuous Feedback Loop

Data tells you what is happening, but your frontline teams—sales and customer success—can tell you why. They're in the trenches every single day, talking to the very people you’re trying to target. Their qualitative insights are pure gold.

You need to create a simple, regular way to capture what they're hearing. This doesn't have to be complicated. It could be a dedicated Slack channel or a quick monthly roundtable where they can share observations on what's resonating and what's falling flat.

An ICP is not a "set it and forget it" document. It's a dynamic tool that requires constant tuning. By regularly gathering feedback and analyzing performance data, you ensure your go-to-market strategy remains perfectly calibrated to your best-fit customers.

This ongoing maintenance is what separates the good from the great. When you actively mix customer feedback, sales data, and market research, your ICP evolves with the market. This continuous refinement can lead to 20-40% lifts in lead conversion rates by ensuring you're always talking to the most resonant, pre-qualified audience. You can dive deeper into this process by learning how to identify your ideal customer profile with dynamic data.

Use Win-Loss Analysis to Find Patterns

Every deal—the celebratory wins and the frustrating losses—is a lesson in disguise. A systematic win-loss analysis is one of the most powerful ways to validate your ICP because it uncovers the "why" behind your results.

Don't just move on after a deal is closed. Dig in.

- Analyze Your Wins: When you land a deal with an ICP-aligned account, what was the compelling event? Which pain point did you solve that no one else could? Find the common threads in your victories and double down on them.

- Examine Your Losses: Why did you lose an ICP-fit account? Was it price? A missing feature? Did a competitor simply outmaneuver you? These insights expose weaknesses in your product, pricing, or pitch.

- Review Out-of-Profile Wins: This is a fascinating one. Did you randomly win a deal with a company that doesn't fit your ICP? It might be a fluke. Or, it could be a signal of an emerging market you haven’t considered. Investigate these outliers.

By consistently tracking your KPIs, listening to your team, and analyzing your wins and losses, you transform your ICP from a static document into a strategic compass that guides your company toward predictable, sustainable growth.

Putting Your ICP into Action with Automation

A well-defined Ideal Customer Profile is a great start, but it’s not the finish line. Its real power isn't unlocked until it’s plugged directly into your daily sales motion. An ICP that just sits in a slide deck is pure theory; the magic happens when you turn that static document into a dynamic, meeting-booking machine.

This is where smart automation comes in. It takes the blueprint you’ve carefully built and puts it to work at a scale no human team could ever hope to match.

From Profile to Pipeline with AI

Think about it: what if you could feed all your ICP criteria—industry, company size, recent funding, specific tech stack—directly into an intelligent system? That’s exactly what an AI-powered sales platform does. It operationalizes your hard work by turning your profile into a set of live search filters.

Instead of your team burning hours manually digging through LinkedIn or company databases, the automation engine handles the grunt work. It continuously scans the market, surfacing thousands of companies and decision-makers who are a perfect fit for your criteria.

Your ICP effectively becomes a live filter for the entire business world, ensuring every single prospect that lands in your pipeline is already pre-qualified.

Scaling Personalized Outreach

Once you’ve found the right accounts, the next hurdle is actually starting a meaningful conversation. We all know that generic, one-size-fits-all emails get deleted on sight. Real personalization demands deep research into each company and contact, which is an impossible task to do manually at scale.

This is where automation shines again. AI-driven platforms like Roger can take over:

- Discover decision-makers: The system automatically pinpoints the right people within your target accounts based on their job titles and responsibilities.

- Generate personalized copy: It analyzes a prospect's LinkedIn, recent company news, and even social posts to craft hyper-relevant, research-backed messages.

- Execute multi-channel sequences: It can manage a sophisticated sequence of touchpoints across both email and LinkedIn, complete with smart follow-ups to keep the conversation going.

This frees up your team from the manual, soul-crushing tasks of prospecting and copywriting, allowing them to run a highly personalized outbound motion without the burnout.

Your Ideal Customer Profile defines the who and why of your sales strategy. Automation provides the how—executing that strategy with precision and scale, freeing your sales team to focus on what they do best: building relationships and closing deals.

Finding Prospects Ready to Engage

By operationalizing your ICP, you ensure your team is always fishing in the right pond. The next step is to add a layer of timing. Leveraging intent data is key to identifying high-intent leads that aren't just a good fit, but are ready to talk now. These signals could be anything from a company hiring for a specific role to them actively researching solutions like yours.

When you combine a razor-sharp ICP with intelligent automation, you're not just prospecting anymore—you're building a predictable and efficient revenue engine. It’s no longer about simply finding potential customers; it's about finding the right customers at the right time and hitting them with a message that truly connects. This is how you get your reps out of spreadsheets and into qualified meetings.

Got Questions? Let's Talk ICPs

Once you start putting your ICP into practice, some real-world questions always pop up. Nailing these details is often what separates a powerful sales tool from a document that just collects digital dust in a forgotten folder.

Let's clear up a few of the most common ones.

How Often Should I Refresh My ICP?

Your ICP isn’t a one-and-done project. It's a living, breathing guide for your GTM strategy. A solid baseline is to give it a full review and update at least once or twice a year.

But sometimes, you need to revisit it sooner. Certain events should trigger an immediate ICP check-up:

- You've just launched a major new product or service.

- You're breaking into a brand-new market or industry.

- A major competitor just changed the game.

- You see a sudden, worrying dip in performance from your "ideal" accounts.

Think of it like the GPS in your car. It's great, but you still need to update the maps every so often to account for new roads and closures. Regular check-ins keep your team heading in the right direction.

Can We Have More Than One ICP?

Yes, and you probably should. It’s totally normal—and smart—for a business to have multiple ICPs. This is especially true if you sell different products or serve distinct industries.

A great example is a cybersecurity company. They might have one ICP for scrappy tech startups who need a simple, scalable solution and a completely different one for large banks that require enterprise-grade compliance and security features.

The trick is to treat each ICP as its own separate playbook. That means unique messaging, different value propositions, and maybe even a dedicated sales pod for each. Trying to smoosh them all together into one generic profile just leads to weak, unfocused outreach that doesn't resonate with anyone.

The whole point of an ICP is to be ridiculously focused. If you have several amazing-but-different customer segments, give each one its own focused ICP. Don't settle for one blurry, generic profile.

Ready to turn that laser-focused ICP into a steady stream of qualified meetings? Roger plugs directly into your ICP to run your entire outbound motion—from finding the right people to writing hyper-personalized emails and putting meetings on your calendar. Start scaling your pipeline today.